Guarding Against Identity Theft

As 2013 ended, the federal Bureau of Justice Statistics released its 2012 Victims of Identity Theft report. Its statistics were sobering. About one in 14 Americans aged 16 or older had been defrauded or preyed upon in the past 12 months, more than 16.6 million people.

Ideas for Your 2013 Tax Refund

If you have already received your refund for the 2013 tax year or are about to receive it, you might want to think about the destiny of that money. Here are some possibilities.

Apply for Social Security... Now or Later?

When it comes to the question of Social Security income, the choice looms large. Should you apply now to get earlier payments? Or wait for a few years to get larger checks?

3/17 Weekly Update

Oversees Headlines Hamper Stocks: Would Crimeans vote to leave Ukraine and join Russia on March 16? To what degree was China’s economy cooling off? These questions preoccupied Wall Street last week, and the Dow, S&P 500 and Nasdaq all turned south. The 5-day performances: S&P, -1.97% to 1,841.13; Dow, -2.35% to 16,065.67; Nasdaq, -2.10% to 4,245.40.

3/10 Weekly Update

Having gained 1.00% across five days, the S&P 500 settled at 1.878.04 Friday, yet another record close. Friday’s positive jobs data also factored into weekly advances for the Nasdaq (+0.65% to 4,336.22) and Dow (+0.79% to 16,452.72)

Will There Be a Bond Bubble in 2014?

This might not surprise you: 2013 is going in the books as the worst year bond funds have ever seen. According to TrimTabs Investment Research, investors yanked $72 billion out of bond mutual funds in 2013 – all of it after May. Those net outflows alone exceeded the record of $63 billion seen in 1994. The common perception: the bond bull is history....

3/3 Weekly Update

Stock end February on New Record High: On February 28, the S&P 500 settled at a new record close of 1,859.45 and a gain of 1.26% on the week, even with growing concerns about Russian military action in Ukraine. The Dow stood at 16,321.71 after a 1.36% weekly advance; the NASDAQ ended the week at 4,308.12 with a 5-day gain of 1.05%

Asset Location & Timing to Reduce Taxes in Retirement

You can’t control what happens with the tax code, but you can control how your savings are held. As various types of investments are taxed at varying rates, some investments are better held in taxable accounts and others in tax-deferred accounts.

2/24 Weekly Update

NASDAQ ADDS TO YTD GAINS: the tech-heavy benchmark rose 0.46% during this past abbreviated trading week, wrapping up Friday at 4,263.41; in contrast, the Dow and S&P 500 each slipped a bit over four days. After a 0.32% weekly loss, the Dow stood at 16,103.30. The S&P settled Friday at 1,836.25, losing 0.13% on the week.

Wise Decisions with Retirement in Mind

Some retirees succeed at realizing the life they want, others don’t. Fate aside, it isn’t merely a matter of stock market performance or investment selection that makes the difference. There are certain dos and don’ts – some less apparent than others – that tend to encourage retirement happiness and comfort.

![2/17 Weekly Update [WATCH!]](https://images.squarespace-cdn.com/content/v1/648c6df3d50397623855b25e/1695328475111-45ISGL5HXIW2Y1GN3AJG/WEVU+overlay+-+play.png)

2/17 Weekly Update [WATCH!]

Stocks really turned around last week, as these five-day index performances attest: DJIA, +2.45% to 16,154.39; NASDAQ, +2.83% to 4,244.02; S&P 500, +2.46% to 1,838.63.

![2/10 Weekly Update [VIDEO]](https://images.squarespace-cdn.com/content/v1/648c6df3d50397623855b25e/1695328480719-BT7U1ZMVX0GDQRLS66IP/WEVU+overlay+-+play.png)

2/10 Weekly Update [VIDEO]

Investors bought back into stocks Thursday and Friday, offsetting last Monday’s major plunge. That resulted in the following weekly performances: DJIA, +0.61% to 15,794.08; NASDAQ, +0.54% to 4,125.86; S&P 500, +0.81% to 1,797.02.

Why Does Family Wealth Fade Away?

In the late 19th century, industrial tycoon Cornelius Vanderbilt amassed the equivalent of $100 billion in today’s dollars – but when 120 of his descendants met at a family gathering in 1973, there were no millionaires among them.

2/3 Weekly Video Update

As expected, the Federal Reserve announced last week that it would reduce its monthly bond purchases by another $10 billion starting in February. Wall Street struggled for most of the week, with the 5-day performances as follows: DJIA, -1.13% to 15,698.85; NASDAQ, -0.59% to 4,103.88; S&P 500, -0.43% to 1,782.59.

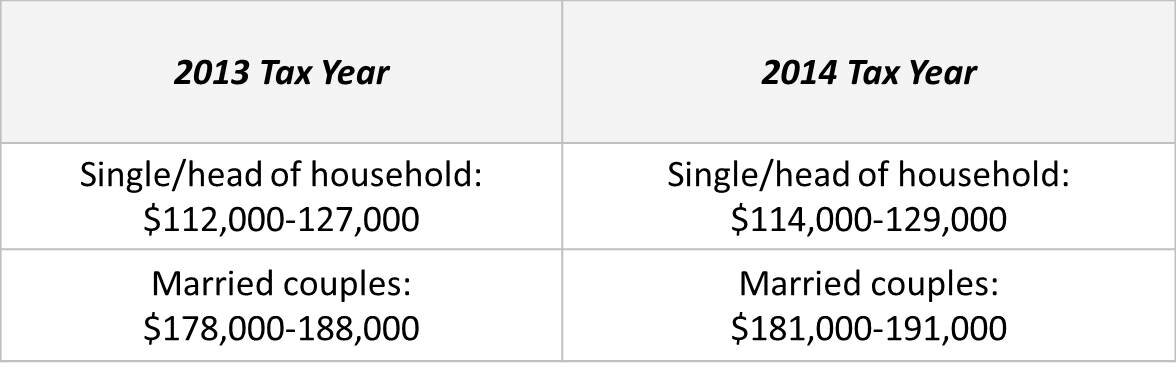

2014 IRA Deadlines Are Approaching

Financially, many of us associate April with taxes – but we should also associate April with important IRA deadlines.

1/27 Weekly Video Update

Weak manufacturing data from China and an exit from emerging market currencies triggered a 2-day global sell-off at the end of last week. The Argentine peso dropped 15% in 5 days, and the Russian ruble, South African rand and Brazil real also slumped. As a result, the DJIA had its poorest week in more than 2 years (-3.52%). The Nasdaq lost 1.65% for the week while the S&P 500 fell 2.63%. At the close Friday, here was where the big three stood: S&P, 1,790.29; DJIA, 15,879.11; NASDAQ, 4,128.17.

Making Your Money Work Harder in Retirement

When planning for retirement, people naturally think about the big things – arranging sufficient income, amassing enough savings, investing so that you don’t outlive your money, managing forms of risk. All of this is essential. Still, there are also...

1/21 Weekly Update (WATCH - ALL NEW!)

Thanks to a 0.55% 5-day advance, the tech-heavy Nasdaq became the first of the big three to go positive so far for 2014. The Dow gained 0.13% last week; the S&P 500 retreated 0.20%. Friday, the indices settled as follows: DJIA, 16,458.56; NASDAQ, 4,197.58; S&P, 1,838.70.

1/13/14 Weekly Update

The first full trading week of 2014 brought 5-day gains for the S&P 500 (0.60%) and Nasdaq (1.03%) but a 0.20% pullback for the Dow. Friday, the big three closed as follows: DJIA, 16,437.05; NASDAQ, 4,174.67; S&P, 1,842.37.

1/6 Weekly Update

Speaking in Philadelphia Friday, Federal Reserve chairman Ben Bernanke asserted that the economy has made “considerable progress”, and that there are “grounds for cautious optimism abroad.” His remarks didn’t give stocks much of a lift to end the week. From December 30-January 3, the S&P 500 lost 0.54%, the Dow 0.05% and the Nasdaq 0.59%. The closing prices Friday: Dow, 16,469.99; Nasdaq, 4,131.91; S&P, 1,831.37.